Banks funding the biodiversity loss connected to food production have been identified in a new report by campaigners Portfolio.earth.

The report was prepared with the support of Dutch consultancy Profundo whose clients include Rabobank, Chatham House, and the European Parliament, as well the UK’s Vivid Economics.

It said 20% of bank loans and under writing to the fishery and agriculture sector had a direct impact on biodiversity, particularly from agricultural chemicals, fishing, and farming.

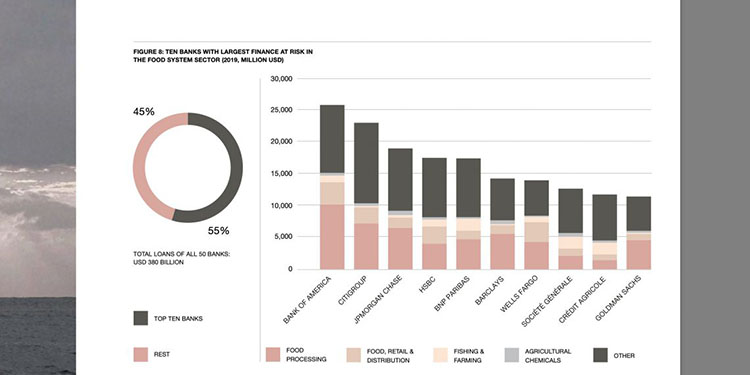

In 2019, US$380 billion worth of loans and underwriting were provided to this sector from the banks included in the research.

The campaigners want banks to disclose and radically reduce their impact on nature, governments to rewrite the rules of finance to hold banks liable for damage caused by their lending, and a common right for people to stop banks from causing serious harm.

They include researcher Mario Rautner, formerly of Greenpeace and Global Canopy, and Liz Gallagher, who was at E3G, a climate change think tank.

Across all investments, the report said that last year the world’s largest banks invested more than US$2.6 trillion, around the whole of Canada’s GDP, in sectors governments and scientists agree are the primary drivers of biodiversity destruction.

40% of banks have no exclusions against activity damaging biodiversity

At risk, for example, are bees and other insects that pollinate crops estimated to be worth more than US$200 billion per year. Unsustainable practices cause a loss of ecosystem services of between $4 and 20 trillion every year from land-use change alone.

The three European banks within the top ten listed invest heavily in the food sector, while US banks provided slightly more finance on average to companies in the transport and logistics than banks from other regions.

While food production has been identified as one of the largest drivers of biodiversity loss globally, in terms of investment funds, it attracted less than infrastructure, metal and mineral mining and fossil fuels.

Unsurprisingly, Rabobank has the largest percentage of its total assets linked to the food systems. Bank of America, Citigroup and JPMorgan Chase were identified as the largest absolute investors.

The companies receiving the largest share of the funding were supermarkets, food processing companies, and international grain traders like Cargill, Archer Daniels Midland, and Bunge.

The report found 40% of all banks have no exclusion activities, meaning they can fund any project despite its impact on biodiversity. Seventy per cent of 150 banks and investment firms analysed in 2019 have no commitments to prevent deforestation. This shows that voluntary measures are insufficient, the campaigners say.

While their policies do not go far enough, European banks perform best in biodiversity protection. Out of 100 they scored on average 21.7, nearly twice that of the seven North American and two African Banks, at 12.2 each.

The report found the size of a bank is not an indicator of its ability and willingness to develop biodiversity-related policies.

Funded mainly by US and European banks, the food and agriculture sector is a $8.7 trillion industry that comprises 10 per cent of global consumer spending. The report said 65 per cent of poor working adults rely on agriculture for their livelihoods.

Agriculture provides livelihoods for 2.5 billion people, and is the largest source of income and jobs for poor, rural households. Dependence on a functioning ecosystem is the foundation of agriculture, so, biodiversity and the food economy are highly interrelated.