Foodtech speeds up is growing faster than established food companies – with startup valuations up by 156 per cent over the previous year. And direct-to-consumer created €84 billion in value.

The State of European Foodtech 2021, by Five Seasons Ventures and dealroom.co, describes last year as an inflection point, with the €2.4 billion invested in startups last year 12 times higher than the 2013 figure.

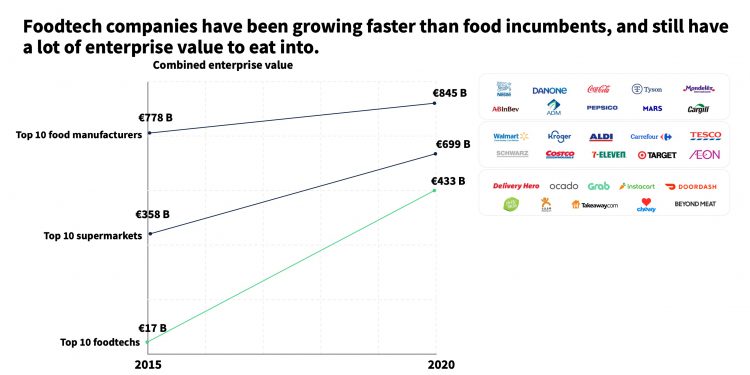

The combined enterprise value of the world’s top 10 food manufacturers, including Cargill, Mondelez and Tyson grew from €778 billion in 2015 to €845 billion. Top supermarkets including Walmart, Carrefour and Tesco grew from €358 billion to €699 billion in that time. But the top 10 food techs grew from €17 billion to €433 billion. They include Doordash, Beyond Meat and Ocado.

European foodtech unicorns are now worth a combined €92 billion, after a huge bump in enterprise value during 2020.

The founders of online grocery retailer La Fourche say in the report that, “During the first lockdown, industry wide we gained at least five or six years of growth, and those changes are here to stay.”

They add, “Our users constantly challenge us on supply chain transparency and organic, ethical goods. Our consumers have become a core part of our product development strategy for our new own-brand products, as co-creators.

“The hypermarket era is over. Consumers are evolving, and shifting towards selecting different players based on different needs.”

“Retailers are more sensitive to the fragility of global supply, in this era of climate uncertainty”

As consumers grow increasingly interested in sustainable alternatives, investments and valuations in the plant-based and cell-based sector are 10 times higher than five years ago.

And, given the inefficiencies in the food supply chain uncovered by Covied-19, investment in farming robotics and automation grew more popular.

Global VC investment in farm management and robotics reached €1 billion in 2020, up from €457 million in 2015.

One startup to benefit is Infarm which builds modular, vertical farming units for supermarkets, restaurants, and distribution centres. They have installed more than 1,000.

The founders say, “Each in-store farm uses 95 per cent less water and 75 per cent less fertiliser than soil-based agriculture; we save thousands of food kilometres by not shipping from abroad, and we don’t pump harmful chemicals into soil or groundwater.

“Today, 90 per cent of electricity used throughout the Infarm network comes from renewables, with a target to reach zero emission food production next year.

“Retailers are becoming more sensitive to the fragility of the global supply chain, particularly in this era of climate uncertainty.

“Retailers’ commitments to these initiatives resonate with the demands of consumers themselves. Our clients see Infarm as providing an opportunity to expand the diversity and size of their basket of fresh produce offerings and stand out from their competitors, while increasing attraction and footfall traffic.”

The report goes on to say that almost all foodtech speeds up unicorns are consumer-facing, and the race for the first primary production unicorn is on.